Financial markets record strong gains as the U.S. Federal Reserve hints at peaking interest rates

Opinion as of January 10, 2024

Chhad Aul, Chief Investment Officer and Head of Multi-Asset Solutions, SLGI Asset Management Inc.

Highlights

- U.S. equity markets finished 2023 on a high note: the S&P 500 climbed 24% and the Nasdaq Composite soared 43%

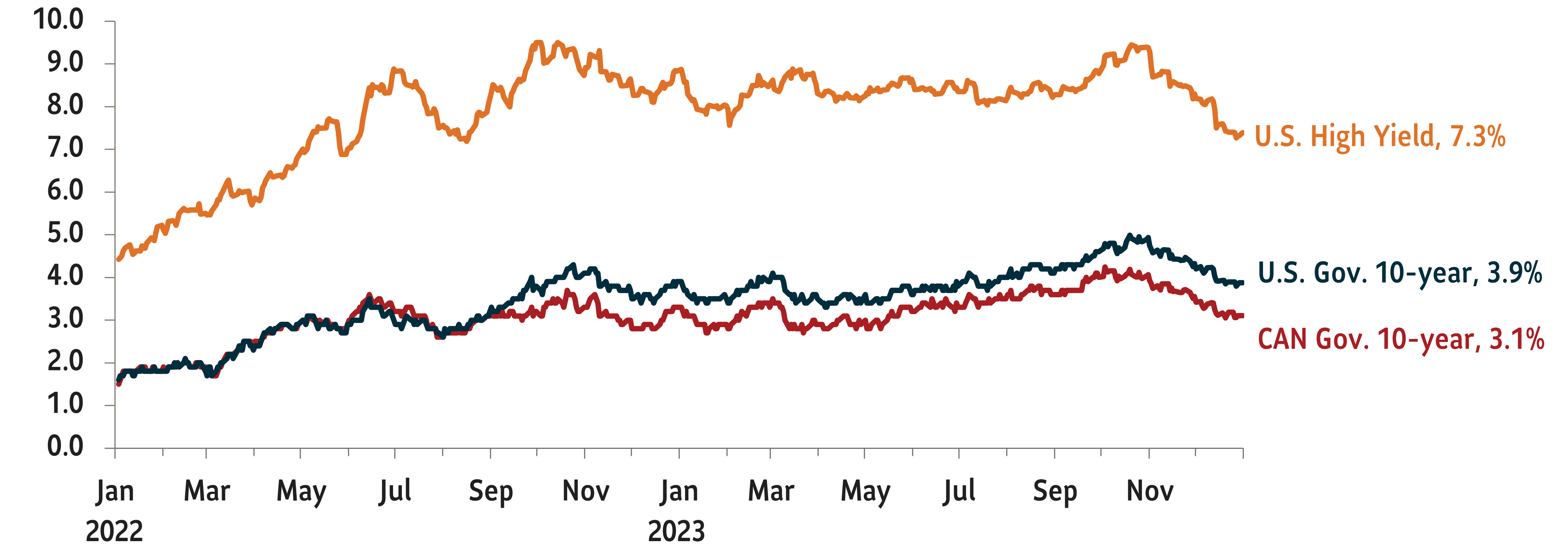

- After climbing to nearly 5% in October, U.S. 10-year Treasury yields ended 2023 below 4%

- The Bloomberg Global Aggregate Total Return Index gained 10% in the final two months of 2023, the best two-month performance since 1990

- Both headline and core inflation continued to fall in 2023. But December’s Consumer Price Index (CPI) rose for the first time since September

- The U.S. economy showed considerable resilience in 2023 with unemployment at just 3.7% in November

Equity and bond markets rallied during the final two months of the fourth quarter (Q4) of 2023. That was in stark contrast to the volatility financial markets experienced in October, when 10-year U.S. Treasury yield spiked to a 16-year high of 5%. But a slew of reports showing slowing inflation and moderate but still growing job numbers injected momentum back into markets in Q4 2024. Also, a clear message from the Fed signaled that interest rates have peaked. Markets then climbed higher and seemed to overcome geopolitical uncertainties.

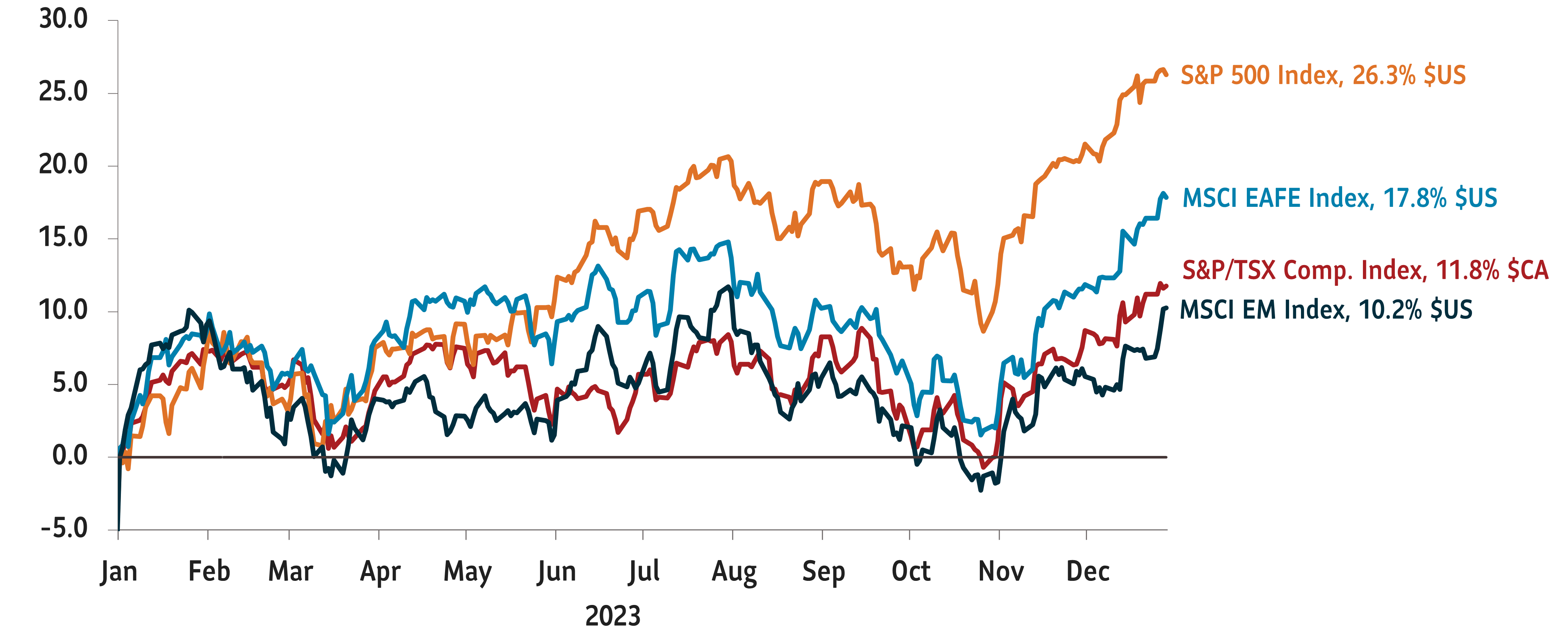

Equity markets rallied in Q4, 2023

Total return, indexed to 0 as of January 1, 2023

All this pushed down the 10-year U.S. Treasury yield to below 4% in late December. Encouraged by easing in financial conditions, the benchmark S&P 500 index jumped almost 24% in 2023. Euphoria about artificial intelligence helped the tech-heavy Nasdaq-100 index post its best performance since 1999. After two bad years, bonds found their footing too. The Bloomberg Global Aggregate Total Return Index jumped 10% in the final two months of 2023, its best two-month performance since 1990.

Bond yields fall from multi-year highs

U.S. and Canada 10-year bond yields

While markets had an impressive run in 2023, we expect economic data to get a bit noisy over the next while. For instance, inflation, which trended down nicely for the past few months towards the Fed’s target of 2%, hit a bump in December. The U.S. Consumer Price Index (CPI) increased 3.4% in December, the highest since September. While services costs remained steady, goods disinflation showed signs of stalling. Markets currently expect the Fed to cut rates as early as March. In our view, this is only possible if inflation continues to fall consistently. That said, we expect the Fed to renew its focus toward growth and full employment in the months ahead.

The U.S. economy defied all recession forecasts and posted robust economic growth in 2023. We think this will be challenging to repeat in 2024. As consumer savings dwindle and nominal corporate profits normalize from slowing inflation, 2024’s growth numbers are likely to be lukewarm. While the U.S. has largely been resilient to rising interest rates, other global economies are struggling to keep up. Our indicators show that the outlook for manufacturing outside the U.S. has worsened. The sector has come under pressure in the Euro Area, U.K., Canada and Japan. We expect manufacturing challenges to pressure overall growth in these regions.

Further, we expect monetary conditions in the U.S. to set the tone for economic growth in other countries. If the Fed doesn’t cut interest rates by as much as expected, this could lead to tighter financial conditions for much of the developed world outside the U.S. and for emerging markets.

Given this scenario, we are largely neutral in our positioning. Our tactical equity and bond weights are close to our strategic weights. Within equities, we are neutral across geographies including the U.S., Canada, other developed markets and emerging markets. Within bonds, we prefer higher quality issues that can withstand credit market volatility. Given the lagged effects of tighter monetary policy, we expect U.S. core fixed income and higher quality Canadian bonds to perform better than risky credit in a scenario of slowing growth. We are less constructive about the conditions in high-yield markets. Despite the historic pace of rate hikes in the past two years, high-yield spreads remain low. We feel the risk-reward from high-yield bonds are disadvantageous and are underweight this asset class.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.